Third Quarter 2022 in Review

We look back at the third quarter of 2022 and the news that shaped it as well as important events in the future.

QUICK TAKEAWAYS

- Bitcoin manages a gain in what was a very challenging period for financial markets.

- The quarter started with investors on high alert following the volatile events of 2Q, but little in the way of new systematic crypto market risks came to light.

- Macroeconomic factors weighed on financial markets where rising rates and stubborn inflation remain chief concerns.

- While a more supportive macro backdrop may help bitcoin, declining trust in sovereign nations and central banks may also act as a catalyst.

- Regulations were highly topical with the release of numerous agency and regulator reports as requested under the White House’s Executive Order.

- Greater regulatory clarity may require legislation, with the stablecoin and digital commodities bills as the most important ones to watch.

- Net reductions in miner bitcoin balances stopped in August, but low prices and rising hash rates mean they are not out of the woods yet.

- The first version of Taro has been released, which gives us a vision of new assets like stablecoins on Bitcoin and the Lightning Network.

Performance Review

Bitcoin Ekes Out a Gain Amidst Route in Financial Markets

The third quarter was tough for nearly every asset across the financial landscape. Stocks, bonds, commodities, and gold were all down during the quarter, with some asset classes down double digits on a percentage basis. Outside of bitcoin, only precious metals (gold miner stocks) and cash (3-month Treasury Bills) posted positive performance during the quarter. Against that backdrop, we think it is impressive that bitcoin was up in the quarter, especially considering how high equity market correlations have been.

Of course, the boogeyman for markets continues to be the macroeconomic backdrop as countries worldwide grapple with the aftereffects of the fiscal and monetary response to COVID-19, chiefly higher than desired inflation. In the U.S., the monetary policy response to elevated inflation has been two-fold: (1) increasing interest rates and (2) and a reduction in the Fed’s balance sheet. This rise in the cost of capital and the subsequent drain of liquidity have created substantial headwinds for asset prices.

Charting Historical Quarterly Performance

Bitcoin started the quarter on uneasy footing following the tumultuous market events of 2Q. Carnage across crypto markets caused first by the sudden implosion of Terra (LUNA) and TerraUSD (UST) and then by poor risk management practices by centralized service providers, which resulted in several bankruptcies, was still in the air as 3Q began. Historically, 3Q has been typically mixed for performance, as bitcoin has typically struggled in the summer months, not unlike equities markets. While past cannot predict the future, we do note that the 4Q has historically been strong for performance.

The Events that Shaped the Quarter

Lingering Fallout from Crash

Without a doubt, the events of 2Q were the financial carnage caused by the implosion of DeFi protocols, notably LUNA/UST, and the counterparty risk that reverberated into CeFi players, like exchanges, lenders, and OTC desks. Much of 3Q was dedicated to sifting through the rubble of the events of 2Q while at the same time keeping one eye out for new systematic risks. Looking back now, we would classify the events of 3Q as a resolution to many of the issues that came to light during 2Q, such as bankruptcy filings and asset sales rather than the exposition of any new problems.

Macro on the Mind

The macroeconomic environment and its impact on markets continue to be top of mind with investors. In July, we got a reading on the first quarter US GDP growth, which, for the second consecutive quarter, showed a contraction. Two consecutive quarters of declining GDP is the commonly agreed-upon definition of a recession, but the White House and US Treasury went on the offensive before the numbers were even released to dispel that notion. The economic cycle dating body, the National Bureau of Economic Research (NBER), has yet to opine on the matter but will likely take many months if ever to confirm a recession. Unfortunately, the distinction likely means little to investors given the current state of markets.

Inflation and interest rates have yet to recede from the national consciousness. Investors got a bit of reprieve over the summer when the July CPI reading on August 10th came in significantly lower than expected. Markets reacted favorably to the data point, rallying sharply and sending forward Fed funds rate expectations down. Unfortunately, the euphoria was short-lived, with the August CPI reading on September 13th coming in hotter than expected. The September 16th FOMC meeting (there was no meeting in August), which raised the Fed Funds rate another 75bps, confirmed the Fed’s continued resolve to fight inflation through higher interest rates.

One final macro item that continues to be on investors’ minds is the strength of the US dollar (USD). The DXY Index, the value of the USD vs. a basket of currencies (currency weights: EUR - 57.6%, JPY - 13.6%, GBP - 11.9%, CAD - 9.1%, SEK - 4.2%, CHF - 3.6%), is on a tear this year, up 17.2% year-to-date. In its wake, the British Pound Sterling (GBP) has been particularly concerning, falling 22.6% versus the USD and hitting a new all-time intraday low. The aggressive rate policy in the US appears to be having knock-on effects with other currencies and economies. The strength in the US dollar could be having a deleterious impact on the demand for bitcoin, but dollar strength itself is likely symptomatic of a much larger factor, the rise in real interest rates.

Regulation Clarity Coming into View

This quarter saw the publication of 9 (10 now with the FSOC report this week) reports requested by the White House under its March 9th Executive Order on Ensuring the Responsible Development of Digital Assets. With the reports, the White House heralded its “first-ever comprehensive framework for the responsible development of digital assets.” While much of what was outlined in the framework was duplicative of current agency and regulator activity, the White House did continue to push the ball down the field for US-issued Central Bank Digital Currency (CBDC). Nothing we read indicates the White House is coming at the digital asset industry with a heavy hand and thus should be viewed as supportive of the industry. The Office of Science and Technology Policy within the White House did have some sharp comments on proof-of-work (PoW) mining’s impact on the environment but did acknowledge that PoW mining accounts for a small portion of the world’s greenhouse gas emissions, just 0.2% - 0.3%. For those seeking ultimate regulatory clarity on digital assets, the White House’s framework probably fell short on key topics. That clarity will likely have to come from legislators, either through the stablecoin bill being considered by the House Financial Services Committee or the digital asset commodity bill from the Senate Agriculture Committee.

Miners Halt Net Selling

According to filings through August, public bitcoin miners have halted the net reductions in bitcoin balances that started during the market correction in May. August data reflect a slight uptick in total miner balances, indicating that they are holding on to some portion of the bitcoins they mine. This is in contrast to activities in May, June, and July, during which public miners were offloading large bitcoin balances to shore up balance sheets. With miners back to a slight net accumulation mode, albeit too early to call it a trend, a short-term overhang is potentially removed from the market, with the caveat that they are not out of the woods yet. Miners are still selling much of what they mine, but monthly sales of bitcoin by public miners, which peaked in June at an estimated $341M, were down to an estimated $97.6M in August.

Flow of Funds Stabilizes in the Quarter

The flow of funds into bitcoin-backed exchange-traded products, trusts, and closed-end funds was evenly balanced with outflows during the quarter. This represents a stabilization compared to the net outflows seen last quarter but is still a far cry from the massive inflows driven by the ProShares Bitcoin Strategy ETF (BITO) launch in 4Q21.

Looking Ahead to 4Q22 and Beyond

Bitcoin Forms a Base

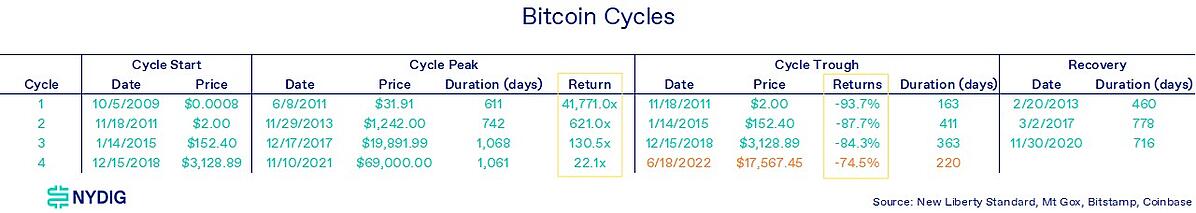

It is possible that the $17.5K intraday low that we saw at the depths of the market dislocation in the middle of June will be this cycle’s low. That June level represents a 74.5% drawdown from the intraday high of $69K in November 2021. We say this for two reasons. First, the continued upheaval in traditional markets in 3Q has not resulted in downward pressure on the price bitcoin. In fact, bitcoin was up slightly in the quarter. Given this price reaction amidst continued bearish macro news may be an indication that the excesses have been wrung out of crypto markets.

The second reason is that this bitcoin cycle, while different in its drivers than previous cycles, is shaping up not too dissimilarly from the previous ones. As a reminder, bitcoin has undergone four major price cycles, each of which has been characterized by a parabolic price rise followed by a steep drawdown. With that understanding, bitcoin’s price trajectory in this cycle is fairly similar. The one difference is that the trough-to-peak returns have less amplitude and the peak-to-troughs, which we’re in right now, have increasingly shallower depths. We think this demonstrates the growing maturity of the asset class.

The following is a chart of the duration and severity of the current drawdown in comparison to the previous cycles. While no guarantee of future performance, we do find comparisons as helpful guideposts. This cycle may not repeat exactly, but history often rhymes in crypto.

Loss of Trust in Central Banks Benefits Bitcoin

As the recent episode in the UK has exposed, investors and citizens may be increasingly losing faith in elected officials and central banks as this global economic morass continues. In late September, UK Chancellor of the Exchequer, Kwasi Kwarteng, unveiled tax cuts for the wealthy that were received unfavorably by markets, causing the GBP and gilts (UK government bonds) to fall precipitously. This then required intervention by the Bank of England via quantitative easing (buying gilts) to prevent financial contagion from spreading to pension plans, which are heavy owners of gilts. If this all seems like a strange and confusing turn of events, one that might undermine trust in central banks, fiat currencies, and the prudent governance of sovereign nations, we would agree. While the reality is that central banks have intervened in the market and monetary matters since their very creation, the general populace now seems to be slowly awakening to this fact. While all the forces at play might not be evident, a growing awareness that all is not right in the financial world seems to be increasingly pervasive in the US and abroad. Famed investor Stanley Druckenmiller seems to agree, and in a recent interview opined that cryptocurrencies like bitcoin might experience a “Renaissance” because people would lose trust in central banks. In that future state, bitcoin might be most useful in a sudden and sharp fiat devaluation or debasement as opposed the gradual loss in value that we call inflation. Certainly, the recent drops in GBP and RUB (with Russia’s invasion of Ukraine) in which bitcoin prices held steady seem to offer some level of empirical support for that idea.

Regulation Pushes Forward, But Immediate Clarity is Unlikely

As mentioned previously, we think the two most important bills to watch are the bipartisan stablecoin bill coming from members of the House Committee on Financial Services and the bipartisan Digital Commodities Consumer Protection Act coming from members of the Senate Agriculture Committee. Unfortunately, with a midterm election coming in a few weeks and a potential change in control of the House or the Senate, neither piece of legislation is likely to get signed anytime soon. Our guess is that stablecoin legislation is likely the first of the two to get signed into law, but we have yet to see even the initial text of the document. The digital commodities bill, which would be welcomed by the industry as it places the CFTC in charge of the largest assets by market value, is likely going to take some time, perhaps a year, before being signed into law. Of course, all regulatory paths may be influenced heavily by the outcome of the upcoming elections. Rest assured, even though we won’t likely have full regulatory clarity by year-end, progress is being made.

Miners Are Not Off the Hook Yet

As discussed earlier, public miners ceased their net reduction in bitcoin balances in August (September data is not widely available yet). Factors such as price declines, high energy prices, electricity curtailment, and idiosyncratic plant disruptions were all at play during the summer months. This does not mean, however, that things are stable for miners. Bitcoin prices, while still off the bottom, are still lingering near the lows. Complicating matters, cooler temperatures have allowed miners to consistently run their rigs, pushing the network hash rate to new all-time highs.

These two items, low prices and increasing hash rate, are affecting the value of hashes provided by the miners, a metric dubbed the hash price. This in turn affects their revenue. Unfortunately for miners, the network hash price is lingering near the lows seen right after the halving in 2020. For this metric to improve, either the hash rate of the network has to come down or bitcoin prices need to go up. Rest assured, however, that current prices are still well above breakeven prices for miners with current generation rigs and access to cheap power.

Taro Alpha Offers a Glimpse into Stablecoins on Lightning

At the end of the quarter, Lightning Labs released an alpha version of its Taro software, a technology that was formally introduced at the Bitcoin 2022 conference in Miami. Taro will ultimately allow users to mint, send, and receive unique assets such as stablecoins and NFTs over Bitcoin and the Lightning Network. This release is just the first version, but we think it offers a tantalizing glimpse at the future of assets other than bitcoin on the Bitcoin network. It is still early days, however, but getting Taro in the hands of the technical community and early adopters is an important first step. According to the release details, Taro in its alpha form is not presently available on the Lightning Network, the high-speed, low-cost network that rides on top of Bitcoin. Given how big stablecoins have become in crypto (collectively, they account for $150B in market cap), we think there are interesting real-world and crypto-specific use cases for Taro. We will be keeping a close eye on Taro is its expanding capabilities going forward.

Closing Thoughts

Bitcoin bounced back this quarter, impressive considering the issues in financial markets and macroeconomic concerns. With inflation remaining high, it is difficult to predict a point at which the current rate-rising regime changes. Ultimately, we think that the issues bubbling to the surface as a result of the environment could benefit a non-sovereign store of value like bitcoin. By design, Bitcoin is a trustless system, relying on no individual, organization, financial intermediary, or nation-state for operation. We think that could be increasingly appealing given the current state of the affairs with regard to central bank actions and the macroeconomic environment.

Thanks for joining us for this quarterly wrap. Please reach out with any questions or comments.

Sincerely,

The NYDIG Team