IN TODAY'S ISSUE:

- Post-spot ETF euphoria has faded as one popular indicator shows.

- Measures of bitcoin’s volatility continue to sink, hitting new lows. We look at the implications.

- Spot volumes dry up, but derivatives, such as options, show secular growth.

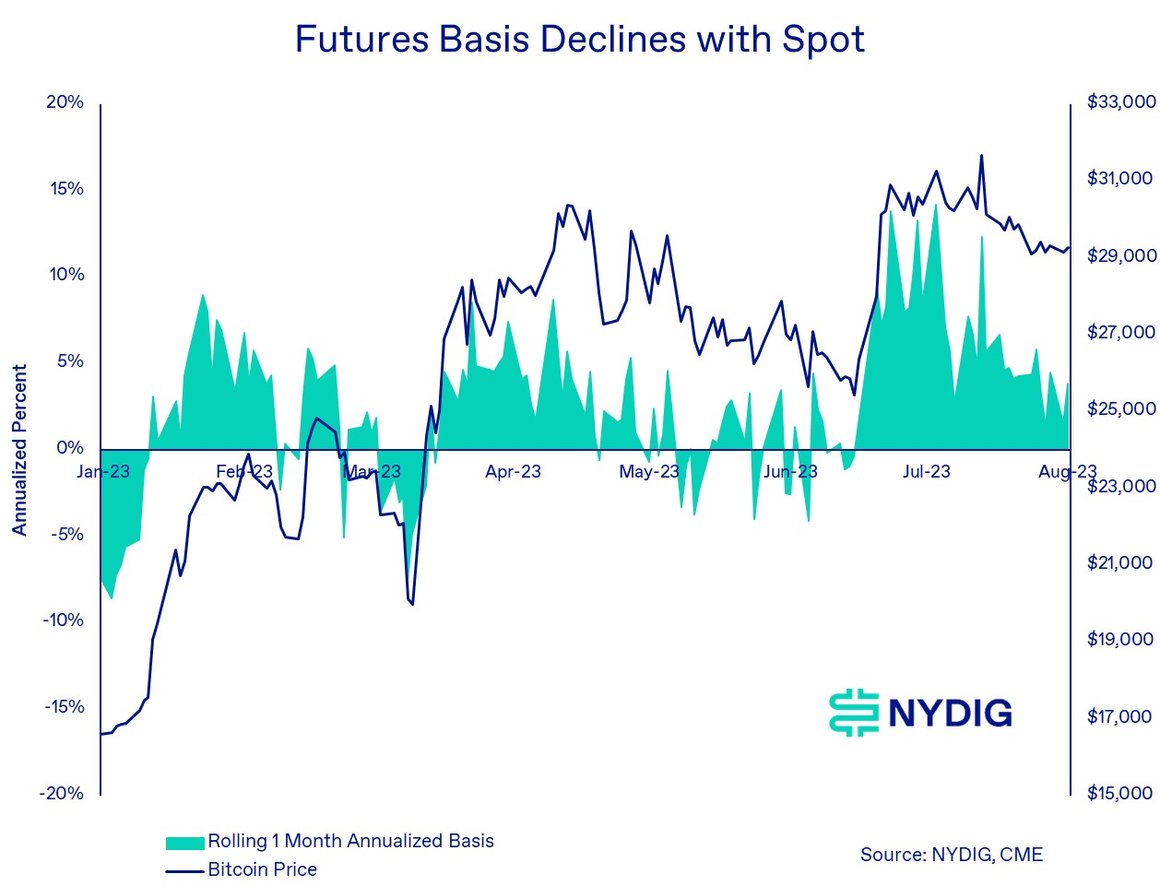

Euphoria Shrinks from the Market as Futures Basis Declines

The futures basis, the difference in price between monthly settled bitcoin futures traded on the CME and the spot price of bitcoin, is showing receding optimism from traders. The rolling 1-month futures basis, expressed in annualized return terms, closed at over 14% during the spot ETF-fueled rally that touched off in mid-June. Since peaking in early July, however, the futures basis is now down to a low single-digit percent. Our interpretation of this trend is that rangebound trading, the inability to sustain momentum over $30K, and a lack of an imminent catalyst during the seasonally slow summer months have dampened trader enthusiasm.

Bitcoin futures trading on the CME is considered an important avenue for institutional investors in the US to express views on bitcoin. The relationship of the price of futures relative to spot prices is a vital indicator to understand trader positioning. When the basis is large and positive, it usually means that traders are expressing bullish views. When the basis is negative, futures are trading below spot, traders are usually expressing pessimistic views. It is important to note the basis tends to be positively correlated with price, with one implication that traders employ trend following or price momentum strategies.

Implied Volatility Continues to Sink

Bitcoin’s volatility, as measured by the implied volatility (IV) of at-the-money (ATM) options, has sunk to new lows amidst rangebound trading and lackluster volumes. IV is a market-based volatility measure based on how ATM options are priced. The new low means that options traders expect the lowest future price volatility since we started collecting the data in 2019.

The second order implication is that certain strategies, such as in call overwriting (holding spot and selling out of the money calls against it), are receiving some of the lowest premiums since we started collecting the data. On the flip side, volatility is cheap, and strategies such as long straddles or strangles (simultaneously buying calls and put) are cheap relative to historical standards. And while the end of summer is typically a quiet time for crypto, we know there’s at least one important event this month, the SEC’s first decision on spot ETF applications.

Spot Volumes Dry Up

Trading of bitcoins on US-based centralized exchanges continues to languish, posting some of their weakest volumes in the recent past. There are several factors likely at play causing this, such as the regulatory overhang, cessation of the banking crisis, summer seasonal effects, banking issues at Binance.US, and declining volatility.

In contrast, derivatives markets, such as options, continue to grow. The likely reason for that is the growth of sophisticated traders and investment strategies using these financial products. We also think the growing awareness by traditional market investors of some of the unique opportunities available within bitcoin derivatives is another reason. And while the declining volatility regime may damper the attractiveness of certain types of derivatives strategies, it opens the door for others, like the ones described in the previous section on volatility.

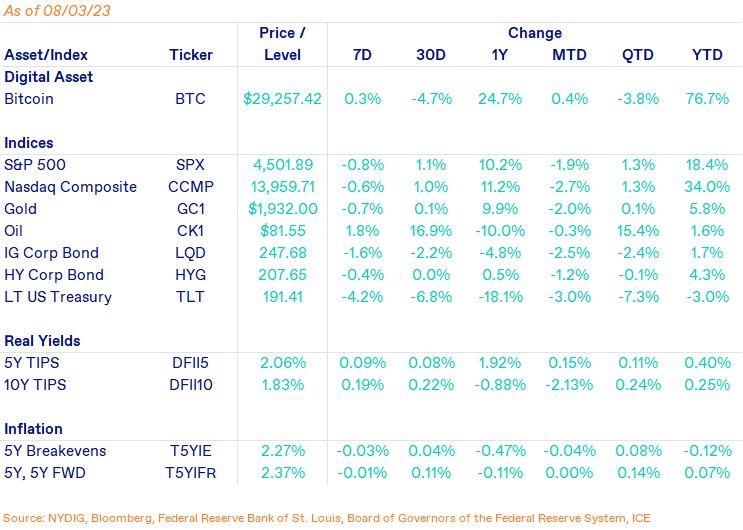

Market Update

Bitcoin continued its sideways trading, ending the week up 0.3%. Bitcoin traders largely ignored the US credit downgrade by Fitch as well as the drama that is playing out across the DeFi ecosystem caused by a hack and credit worthiness concerns of a major borrower. Equities fell on the week, with the S&P 500 down 0.8% and Nasdaq Composite down 0.6%. Gold fell 0.7% as real yields rose, while oil rose 1.8%. Bonds were down on the week, with investment grade corporate bonds down 1.6%, high yield corporate bonds down 0.4%, and long-term US Treasuries down 4.2%.

Important News This Week

Regulation and Taxation:

Asia Crypto Regulatory Frameworks in HK, Singapore Contrast with US Disarray - Bloomberg

U.S. Prosecutors Worry Binance Charges Could Cause Run on Exchange - Semafor

SEC Asked Coinbase to Halt Trading in Everything Except Bitcoin, CEO Says - FT

Investing:

Analysis: Is the Curve Crisis Over? Exploring the Founders' OTC Selling Frenzy - Wu Blockchain

Volatility Shares Kicks Off Race for Ether Futures ETFs, 5 Others Follow with SEC Applications - CoinDesk

Fitch Downgrades the United States' Long-Term Ratings to 'AA+' from 'AAA'; Outlook Stable - Fitch

How Katie Haun and Her $1.5B Fund Have Navigated Crypto’s Year From Hell - Forbes

Companies:

Tether Releases 2Q 2023 Assurance Opinion - Tether

Genesis Digital Assets Expands Bitcoin Mining Activity in ‘Pro-Innovation’ South Carolina - Decrypt

Dubai Awards Full Crypto License to Nomura’s Laser Digital - Bloomberg

Becoming the First Licensed Exchange for Retail Users in Hong Kong - HashKey

Binance Gains Operational License in Dubai - CoinDesk

Crypto Custody Firm Hex Trust Adds AMF, ACPR Registration in France - CoinDesk

GameStop to Pull Support For its Native Crypto Wallets by Nov. 1 - Blockworks

Bitcoin Lightning Coming to Coinbase, CEO Brian Armstrong Says it’s in the Works - CoinDesk

Revolut to Terminate US Crypto Services, Citing ‘Regulatory Environment’ - CNBC

Upcoming Events

Aug 10 - July CPI reading

Aug 11 - SEC response date for Ark 21Shares ETF (Aug 13 is a Sunday)

Aug 25 - CME expiry

Sept 1 - Expected SEC response date for BlackRock iShares ETF