IN TODAY'S ISSUE:

- The SEC sues Coinbase and Binance, but it is important to remember why digital assets like bitcoin matter.

- Billions of people in this world live in regimes in which they cannot trust their government, central banks, or banking systems. For many, Bitcoin can be the difference between life and death, literally.

- Many of us live in increasingly tenuous socioeconomic conditions, in part driven by the rising costs of necessities, such as education, shelter, and health care. Bitcoin can help improve the financial condition of those who own it to help achieve their financial goals.

As the SEC Sues Coinbase and Binance, We are Reminded Why Digital Assets Like Bitcoin are Important

This week, the Securities and Exchange Commission (SEC) sued 2 crypto giants, Coinbase and Binance, for violations of the securities laws. The Binance complaint alleges 13 violations, including failure to register as an exchange, broker-dealer, or clearing agency, the unregistered offers and sales of BNB (originally Binance Coin) and BUSD (Binance USD), the failure to restrict US investors from its platform, and misleading investors. The Coinbase complaint alleges the company failed to register as an exchange, broker-dealer, or clearing agency, and that the company’s staking service constitutes the unregistered offers and sales of securities. Underpinning these lawsuits is the SEC assertion that several digital assets are in fact securities, including Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), Algorand (ALGO), Near (NEAR), Internet Computer (ICP), and Axie Infinity (AXS). It is not our place to opine on the potential outcome of these or any other lawsuits, nor will we evaluate the merits of the arguments put forth. However, we feel strongly about the value and need for digital assets like bitcoin.

The Merits of Digital Assets

It is important to remember that we live in a disclosure-based regulatory regime, not a merit-based one. This means it is the job of regulators to make sure that appropriate disclosures are in place and information is available for investors to make decisions themselves. This was a point Chair Gensler reiterated in a recent speech. While many may find it hard to understand the point of “digital assets” like bitcoin when most assets are already digitized, a comment echoed by Chair Gensler in a recent CNBC interview, the fact that fiat currencies and stock certificate ownership also live in digital ledgers is missing the point of digital assets like bitcoin entirely.

Bitcoin is an Opt-In Economic System

Bitcoin has value because it is a digital asset and payment system outside of the traditional banking and payments system, one conducted on a peer-to-peer basis and controlled by the community of its users. Bitcoin’s users have, via their own free will, opted out of their traditional financial ecosystems and opted into a completely new one. What gives bitcoin value is its users, who demand the asset for any number of reasons. The fact that Bitcoin is digital is completely irrelevant but honestly makes it more similar to traditional investments than dissimilar.

The reasons that people own bitcoin the asset and use the Bitcoin network are varied. Maybe some like the fact that it has a fixed supply, it’s nearly infinitely divisible, or its transportability (just memorize your seed phrase). Others may like it because it is globally transmissible, cheaper to move (via Lightning) than fiat, it can be self custodied, or they expect it to rise in price in the future. And some may just like the logo or the color orange. While there are many reasons to like bitcoin, the point is we don’t begrudge others for their reasons.

For some people, though, a digital payment system like Bitcoin can be the difference between life and death, literally. Billions of people around the world live in authoritarian regimes, or in unsound monetary systems, or have an unreliable banking system. For those people, a technology like Bitcoin is a godsend, not something to be met with derision. Do you think those users care about 60% annual volatility when the alternative is the complete and utter eradication of wealth, either through direct confiscation or hyperinflation? The answer to that is a decisive “no.”

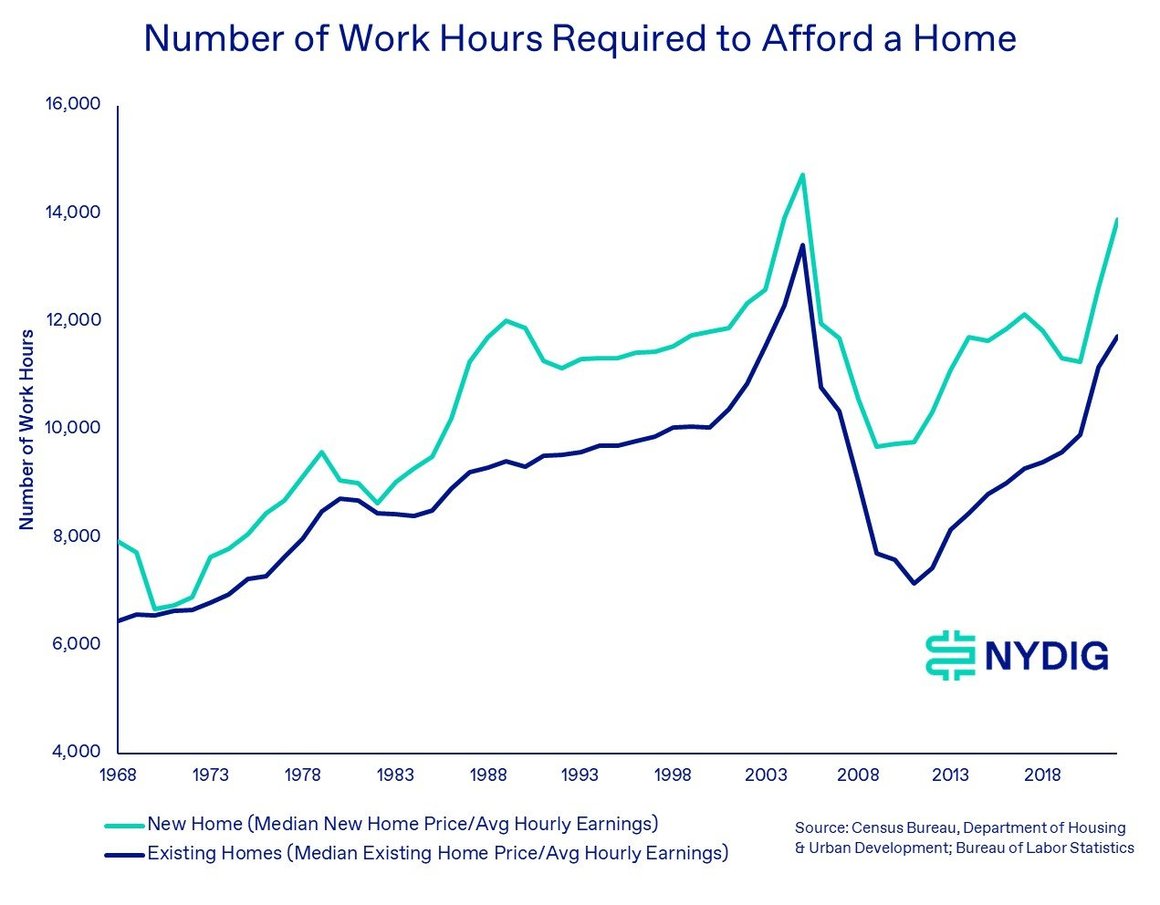

We understand that for many reading this, bitcoin might not mean the literal difference between life and death, but it may be financially. In the US and in many countries around the world, growing income and wealth disparity is becoming societally untenable. For the average American, the ability to provide a better (relative) future for their children is becoming increasingly difficult and a growing source of anxiety for many. Housing, education, health care, child care, and elder care are all becoming more expensive in real terms, making them less affordable for American families. For example, looking at the number of work hours required for the average worker to afford the median new and existing home is illuminating. This eliminates the effects of the “price of money” (inflation) and the secular trend of working fewer hours and ignores the “cost of money” (financing costs). The increase in “cost”, in terms of the number of hours required to work, for the price of a new home is up 75.1% since 1968 and up 81.6% for existing homes. That’s 2.9 more work years for a new home and 2.5 more work years for an existing home. That’s nearly 3 years that we cannot spend with our family and friends or enjoy hobbies and activities. And time is the one thing that cannot be created, regardless of how rich one becomes.

A 75% or 80% increase over 54 years only amounts to only a 1.0% - 1.1% increase annually, and therefore might be imperceptible over the short term. But over the long term, this amounts to a substantial loss of humanity’s most precious resource, time, just to afford a basic societal need, shelter. Why do housing, education, health care, child care, and elder care continue to suffer from these types of intractable trends, while things like electronics, apparel, and food cost less in real terms? A myriad of factors are likely at play, but from a high level, these sectors tend to not benefit greatly from globalization (someone somewhere else making it more cheaply) or technical innovation and efficiencies (making more with less). Historically, both of these factors have been important deflationary drivers, allowing us to get more for less.

It seems unlikely that sprinkling a digital asset like bitcoin on society is going to simply cure all its ills. Perhaps it corrects some of the distortions created by treating our national finances like a public dumping ground, a financial tragedy of the commons. However, bitcoin’s low correlations and high returns can affect the risk and return of portfolios today and hopefully, the financial outcomes of those who adopt it, so that they may not have to spend an increasing portion of their lives working to afford the basic necessities of it. In that respect, bitcoin investment would appear to have a lot of benefits, and we can think of no greater gift than giving families more time together, friends more opportunities to bond, and people to enjoy the things they love doing in this world, whatever that might be. In that sense, we think bitcoin has a lot of merit.

Market Update

Bitcoin fell 1.2% on the week, an amazing feat given the news about Coinbase and Binance that came out over the week. At one point, bitcoin had clawed back nearly all of its losses sustained in the wake of the Binance announcement, a testament to how washed out the sentiment was for the asset. Equities continued to rally with both the S&P 500 and Nasdaq Composite up 1.1%. Gold fell 0.7% on the week while oil rallied 1.7% on a pledge from Saudi Arabia to cut production. Bonds were mixed on the week with investment grade corporate bonds down 0.5%, high yield corporate bonds up 0.7%, and long-term US Treasuries down 1.0%.

Important News This Week

Regulation and Taxation:

SEC Files 13 Charges Against Binance Entities and Founder - SEC

SEC Files Motion for Restraining Order to Freeze Binance US Assets - Reuters

SEC Chair Gensler Doubts the Need for More Digital Currency - CNBC

Show Cause Order Issued to Coinbase - Alabama Securities Commission

The SEC Comes for Crypto - Bloomberg

When Is a Token Not a Security? - Bloomberg

Binance Appears to Have Lied to Lawmakers, Elizabeth Warren Says - Bloomberg

Russian Nationals Charged With Hacking One Cryptocurrency Exchange and Illicitly Operating Another - Department of Justice

Robinhood Ends Support for Solana, Polygon, Cardano - The Block

Coinbase Lawsuit May Finally Send Crypto Debate to Supreme Court - Bloomberg

Investing:

Retail Demand to Remain Strong Ahead of 2024 Halving: JPMorgan - CoinDesk

Bitcoin Developers Feud Over Ending Ordinals Memecoin Frenzy - Bloomberg

Companies:

Binance’s Richard Teng Emerges as CZ’s Heir Apparent - Bloomberg

Binance Hands Rising Star Richard Teng Key Position to Replace CZ - CoinDesk

Crypto Custodian Zodia to Offer Staking With Blockdaemon - CoinDesk

Genesis Bankruptcy Judge Extends Mediation Period - CoinDesk

Lightning Data Firm Launches New ‘Liner’ Index for Bitcoin Yield - CoinDesk

How Amboss is Shaping a More Inclusive Future for Finance - Amboss

Circle Names Heath Tarbert Chief Legal Officer & Head of Corporate Affairs - Circle

Binance.US to Halt Dollar Deposits After SEC Crackdown - Reuters

Upcoming Events

June 13 - CPI reading

June 14 - FOMC rate decision

June 30 - CME expiry