IN TODAY'S ISSUE:

- Bitcoin soars to a new high driven by ETF inflows. We look at how “early” this drawdown recovery came compared to previous cycles.

- A look at the underlying blockchain data suggests that we are still early in the overall cycle.

Bitcoin Hits a New High as Recovery Comes Ahead of “Schedule”

On Tuesday, bitcoin broke through the $69,000 level, hitting $69,324.58 on Coinbase, setting a new all-time high, and recovering from the drawdown that began at the last peak in November 2021. This drawdown recovery and new all-time high comes on the heels of overwhelming demand for the spot ETFs in the US, which have garnered net inflows of $8.9B in just under 2 months of trading.

Comparing the duration of this drawdown to the prior bitcoin cycles, this recovery comes much earlier than the prior two. The first cycle is truncated as bitcoin didn’t have a reliable price until well over a year after it started. This cycle’s recovery comes 469 days after hitting the trough price of $15,460 on November 21, 2022, in the wake of the collapse of FTX. The prior two cycles took 778 days and 716 days to make their recovery from trough price. Said another way, the prior two cycles took about the same time to reach their bottoms as the current one, but this one snapped back much faster. Truly amazing given this size of the asset class today at roughly $1.2T vs the recovery from the 2013 peak when it was a $20.5B asset.

A Look at What the Blockchain Tells Us

As we celebrate a new all-time high, we wanted to delve into the underlying blockchain to understand what it reveals about the network and its usage, setting aside the influence of price. While market and trading activity is often the item of discussion, especially at new all-time high, we are particularly interested in what the blockchain data reveals about the current cycle.

Ownership

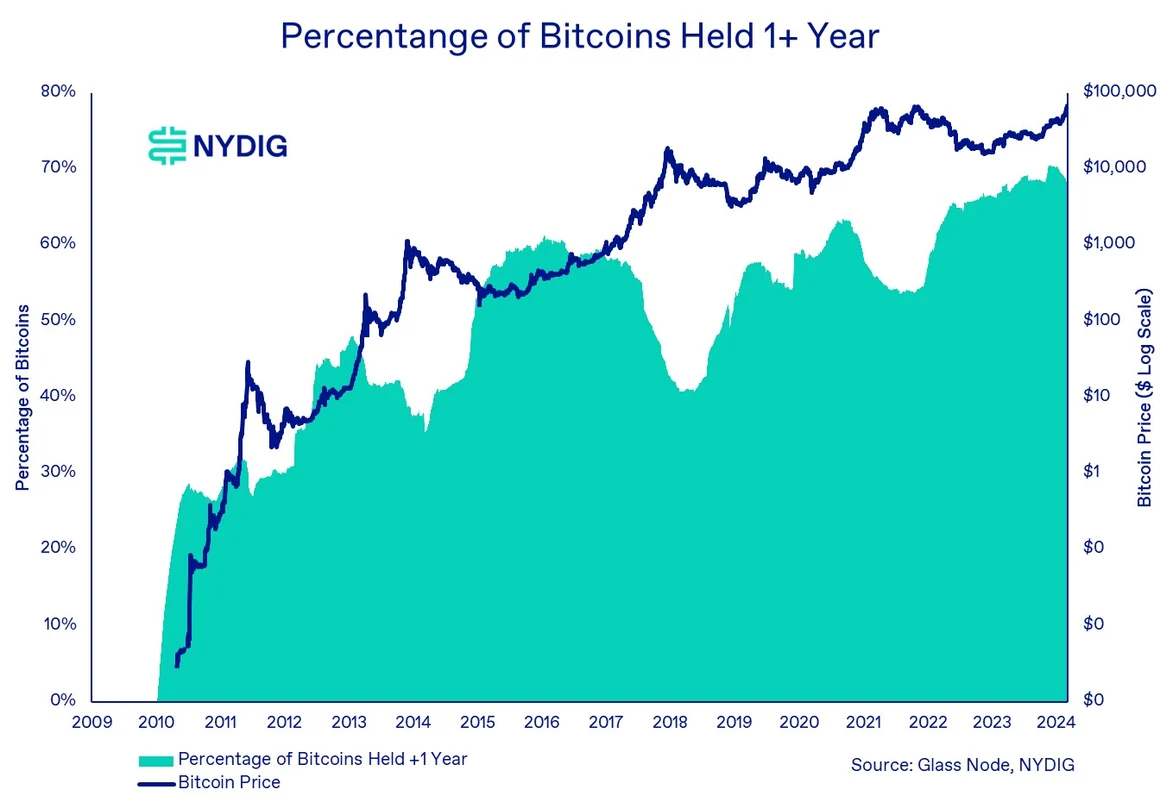

Long-Term Holders Have Yet to Budge

Long-term holders, identified by the percentage of bitcoins that have remained stationary on the blockchain for over a year, have not made significant adjustments to their positions based on blockchain data. Historically, the percentage of coins that have stayed untouched for a year tends to move in opposition to bitcoin's price trends. Typically, as price increases, long-term holders have sold their bitcoin. However, this expected behavior has not materialized yet, suggesting that long-term holders are currently maintaining their positions.

Balances Continue to Come off Exchanges

Balances leaving exchanges was a dominant narrative last cycle that hasn’t shown any signs of changing, with investors continuing to purchase bitcoin on exchanges and then withdrawing them to custodial services and self-storage. Investors continue to reduce the number of coins held on exchange, which given the counterparty and platform risks that characterized a disastrous 2022, is ultimately a good thing long term.

Balances Held by Miners Edge Down Slightly

While not as obvious of a trend as exchange balances, miner balances have edged down slightly recently. This may have to do with price appreciation, capital needs, or refreshing of fleets ahead of the April halving.

Network Usage

A Proxy For Users Continues to Grow

The number of addresses that have non-zero balances, a proxy for the size of the network, recently broke 50 million addresses. This metric, which exhibited peaks and corrections at the last 2 price cycle peaks, is an important proxy for network size and valuation under Metcalfe’s Law (the value of a network is proportional to the square of its user base).

Daily Unique Addresses Still Trending Sideways

The daily number of unique addresses seen interacting on the network has not shown significant growth yet. This is a promising sign for the ongoing cycle, especially considering the spikes observed near the peak of the previous two cycles.

Transaction Fees

Historically, transaction fees exhibited some cyclicality, peaking at or around price cycle highs. While we’ve had two recent bumps in transaction fees, those had to do with BRC-20s – the fungible Ordinals issued on Bitcoin’s blockchain. We have yet to see the cyclical bump in fees normally seen around cycle.

Final Thoughts

Bitcoin has come a long way in a few short months. It wasn’t much more than a year ago that the industry was grappling with the fallout from the collapse of FTX, Genesis, and many other systematically important crypto entities. Undoubtedly, the ETFs have played a substantial role in bringing bitcoin to a new all time high. While the rally has been largely driven by financial markets, a look at the underlying blockchain data suggests that, while the next cycle is well underway, we may likely be far from the top.

Market Update

Bitcoin hit a new all-time high on Tuesday, breaking through the previous high of $69,000, before experiencing significant price volatility. Bitcoin bounced around for the rest of the week as money continued to come pouring into the ETFs, and broke through the $70K level, again setting a new high on Friday. However, after hitting $70,200 on Friday, bitcoin once again experienced a bought of volatility. This volatility around the high might be a new reality until price can show a meaningful breakout.

Bitcoin wasn’t the only asset to hit a new all-time high recently, however. US equity markets and gold continue to set record highs as the S&P 500 rose 1.2% on the week, Nasdaq Composite climbed 1.1%, and gold jumped a whopping 5.4%. Bonds rose as well, with investment grade corporate bonds up 1.5%, high yield corporate bonds up 0.7%, and long-term US Treasuries up 2.2%. Oil rose 0.9% on the week.

Important News This Week

Investing:

BlackRock Plans to Purchase Spot Bitcoin ETFs For Its Global Allocation Fund - The Block

Osprey Bitcoin Trust Announces Exploration of Strategic Alternatives and Voluntary Deregistration - Osprey

GBTC Net Outflows Reach $10 Billion Two Months After ETF Conversion - Blockworks

Regulation and Taxation:

TD Cowen Expects Gary Gensler to Continue Bringing Crypto Cases After SEC Win in Insider-Trading Lawsuit - The Block

Terra’s Do Kwon to Be Extradited to South Korea, Montenegro Court Rules - Bloomberg

Companies:

Arkham Claims to Identify Tesla and SpaceX’s Bitcoin Addresses Holding Nearly 20,000 BTC - The Block

BlockFi Settles With FTX, Alameda Estates for $874.5M - CoinDesk

Upcoming Events

Mar 12 - Feb CPI reading

Mar 20 - FOMC rate decision

Mar 29 - March CME expiry

April 21 - Bitcoin block reward halving